Long before climate change became a catch-phrase, I got interested in sunspot activity. Back then (around about Kennedy’s assassination), my interest was triggered by understanding ice ages. It struck me then that the most plausible, indeed the sort of obvious, explanation of these strange periods had to have something to do with solar activity—rather than sudden shifts of the earth’s upper crust or tectonic plates sliding to the wrong or right places on the planet. Hence my interest in the sun—revisited time and again on the old LaMarotte and also, once, on this new edition.

Today I happened across a reference to raw data on sunspots on this NASA site. It points at this file; it holds averaged sunspot counts per month from 1749 through May 2011. I find such data irresistible; soon I had the values formatted well enough for uploading into Excel. Here, then is a graphic that shows 262 years of sunspot activity, plus five additional months for this year.

Fascinating image—the sun’s cardiogram, you might say. After staring at it for a minute or two and noting that, perhaps, the trend was up, I asked Excel to insert the trend line of these data; it is shown in red. Yes. An upward trend based on 2,887 data points. Just for the fun of it, I also plotted two subsets of these data, each for 20 years, one for the beginning and the other for the end of the period shown above. Those graphics follow, done to the same scale as the first image:

Interesting again. In the last half of the eighteenth century, all three peaks are lower than the two shown for the 1989-2011 period. Right now, to be sure, we are at the beginning of a build-up to a peak that won’t arrive until about the middle of 2014—a peak projected by NASA to be much lower than the last one in 2001.

I love these long, long data sets. They are much more reliable than the Here, Now, Today. In 2007 and 2008, for instance, we’ve had record (2008) and near-record (2007) quiet solar years; and the next peak will also be low. Will it be followed by another deep, wide trough in the 2020s? We don’t know for sure. Is climate change sun-caused of man-caused? If the former, do recent events portend a change in trend? Wait another two-and-a-half centuries to pronounce on that probability. Boy are we little—and is our life short—in contrast to that blaze in the sky that gives it to us—life, that is.

The projections I mention are also from NASA, here:

Thursday, June 30, 2011

Wednesday, June 29, 2011

IMF’s Lagarde

We note with pleasure—the royal we means Brigitte and I—the election of Christine Lagarde to the IMF’s helm. We became aware of her around the time of the economic meltdown in this country in 2008 when, in midst of the chaos, we watched an extended interview with her on television. We sat up in our chairs. Wow, we said! In politics, alas, we are invariably prejudiced in favor of people capable of rational discourse, and this without regard to the position they occupy on the left-right continuum. Lagarde was an advocate of financial bail-outs then, speaking from her position as Minister of Finance and Economy in France under Sarkozy—which was, of course, the rational view of how to preserve the financial system. She wanted to save Lehman Brothers. Brigitte and I favored letting them all collapse, Goldman, AIG, J.P. Morgan, Merrill, the lot. I suppose we’d rather reach the Middle Ages sooner than later, but that is perhaps wishful thinking; and shaking it off, we will listen to reasoned and responsible arguments.

Lagarde, born in 1956, is a thoroughly modern person, Paris-born of academic parents, and a tour de force from childhood forward. She obtained part of her education in the United States at the Holton-Arms college preparatory school in Bethesda, MD, took degrees in law (University of Paris) and in political science (Institute d’études politiques d’Aix-en-Provence). Before she entered politics she worked for the U.S. law firm Baker & McKenzie, on whose behalf she founded the European Law Centre, based in Brussels, which specializes in European Union law. Her career in the French political realm includes service as minister of Trade, of Agriculture and Fisheries, and finally a newly created department of Finance and Economy. Her first concern as head of the IMF will be the Euro crisis, a looming melt-down in Greece—which, if it happens, could domino its way to Spain, etc. She is a charming, independent, very hard-working, and very rational woman, with excellent relations world-wide, not least a good friend of Germany’s Angela Merkel. A shadow over her career is a fairly recent out-of-court settlement of a lawsuit against publicly-owed Crédit Lyonnaise. Some in France think that she corruptly gave the suitor, Bernard Tapie, too much money. Until lanced, this boil may still hurt a distinguished career.

Christine Lagarde is also a distinguished athlete—although this is rarely mentioned in news accounts. She was a member of France’s synchronized swimming team.

Brigitte and I wish her well in her new job—yes, this despite having very guarded views of the IMF as an instrument of the capitalist order, etc., etc. In the end you have to go with people. In the right hands even poor instruments can be effective.

Photo courtesy of the Embassy of France in Washington.

Lagarde, born in 1956, is a thoroughly modern person, Paris-born of academic parents, and a tour de force from childhood forward. She obtained part of her education in the United States at the Holton-Arms college preparatory school in Bethesda, MD, took degrees in law (University of Paris) and in political science (Institute d’études politiques d’Aix-en-Provence). Before she entered politics she worked for the U.S. law firm Baker & McKenzie, on whose behalf she founded the European Law Centre, based in Brussels, which specializes in European Union law. Her career in the French political realm includes service as minister of Trade, of Agriculture and Fisheries, and finally a newly created department of Finance and Economy. Her first concern as head of the IMF will be the Euro crisis, a looming melt-down in Greece—which, if it happens, could domino its way to Spain, etc. She is a charming, independent, very hard-working, and very rational woman, with excellent relations world-wide, not least a good friend of Germany’s Angela Merkel. A shadow over her career is a fairly recent out-of-court settlement of a lawsuit against publicly-owed Crédit Lyonnaise. Some in France think that she corruptly gave the suitor, Bernard Tapie, too much money. Until lanced, this boil may still hurt a distinguished career.

Christine Lagarde is also a distinguished athlete—although this is rarely mentioned in news accounts. She was a member of France’s synchronized swimming team.

Brigitte and I wish her well in her new job—yes, this despite having very guarded views of the IMF as an instrument of the capitalist order, etc., etc. In the end you have to go with people. In the right hands even poor instruments can be effective.

Photo courtesy of the Embassy of France in Washington.

Tuesday, June 28, 2011

Keep Jobs, Cut Pay

Suppose that a company or agency had to cut costs. The budget was shrinking, the sales were down. And suppose the entity responded by lowering the pay of every employee but keeping everybody on the job. Consider it for a moment. Suppose this had developed as our traditional way of dealing with economic swings, up or down. Going in the other direction, everyone would also benefit. The atmospherics of economic life would be quite different. We’d all suffer, benefit equally. Our sense of belonging to a community would be much higher. We’d think of economics as a human enterprise—not as a jungle out there.

Our current system rests on power. First laid-off are the weakest, last the most powerful. Human collectives are a kind of primitive organism. When we are hungry, thirsty, out of breath—the whole body suffers. We don’t lay off our kidneys or livers—or shrink them because there isn’t food enough. Nothing to eat? Let’s lay off our teeth and tongue. No. But when a school system is short of funds, librarians must go. Why the librarians? Why not coaches?

Here and there, rather rarely—in fact I can only think of one case immediately, and cannot find it now, on the web—some enlightened CEO thinks of this solution and implements it. In the case that I recall, it was a privately held firm, somewhere in Ohio, a steel maker, I think, and no doubt those that take hold of this solution are always privately governed. It takes an original sort of person with high gifts of empathy to do what seems to me an obvious and equitable way of going about the business of downward adjustment.

Well, perhaps humanity has not advanced yet, far enough, to take another road—which doesn’t mean that it can’t happen.

Now for one or two more notes. There isn’t work enough to keep everybody busy. This may happen in corporate settings—certainly not in schools or police departments. Very well, give people time off; cut the work-week, preferably by whole days. Concerning pay: should cuts be proportional, thus the same percentage at all levels? That would be equitable but may hurt those at the lowest levels most. Therefore a progressive pay-cut system might be best, one in which those at the top sacrifice more—rather than, as in our system now, not at all.

A third note. If the cause of the economic decline is malfeasance, as in the current recession (which seems to refuse to go away), causing everyone to feel the pain—and it should, indeed, be extended to those on Social Security—would also cause interesting political consequence leading to a much more rapid, decisive, indeed discernible correction of those who brought the event about.

Our current system rests on power. First laid-off are the weakest, last the most powerful. Human collectives are a kind of primitive organism. When we are hungry, thirsty, out of breath—the whole body suffers. We don’t lay off our kidneys or livers—or shrink them because there isn’t food enough. Nothing to eat? Let’s lay off our teeth and tongue. No. But when a school system is short of funds, librarians must go. Why the librarians? Why not coaches?

Here and there, rather rarely—in fact I can only think of one case immediately, and cannot find it now, on the web—some enlightened CEO thinks of this solution and implements it. In the case that I recall, it was a privately held firm, somewhere in Ohio, a steel maker, I think, and no doubt those that take hold of this solution are always privately governed. It takes an original sort of person with high gifts of empathy to do what seems to me an obvious and equitable way of going about the business of downward adjustment.

Well, perhaps humanity has not advanced yet, far enough, to take another road—which doesn’t mean that it can’t happen.

Now for one or two more notes. There isn’t work enough to keep everybody busy. This may happen in corporate settings—certainly not in schools or police departments. Very well, give people time off; cut the work-week, preferably by whole days. Concerning pay: should cuts be proportional, thus the same percentage at all levels? That would be equitable but may hurt those at the lowest levels most. Therefore a progressive pay-cut system might be best, one in which those at the top sacrifice more—rather than, as in our system now, not at all.

A third note. If the cause of the economic decline is malfeasance, as in the current recession (which seems to refuse to go away), causing everyone to feel the pain—and it should, indeed, be extended to those on Social Security—would also cause interesting political consequence leading to a much more rapid, decisive, indeed discernible correction of those who brought the event about.

Monday, June 27, 2011

Two CBO Projections

Hat tip here goes to Monique Magee (Marketsize). She alerted me to a Clusterstock or Chart of the Day. That led me to this Congressional Budget Office report, titled “CBO’s 2011 Long-Term Budget Outlook.” I have reproduced, above, the crucial chart. It shows public debt expressed as a percent of Gross Domestic Product, historically and then extended into the future based on two scenarios. The first of these is called the Baseline, the other CBO calls the Alternative.The Baseline assumes that laws currently in effect will continue to hold force, as written. The Alternative, which CBO views as the more likely, assumes changes to current law. Baseline results in debt rising from 69 percent of GDP (CBO’s estimate) to 84 percent by 2035—which is, when you think about it, pretty grim! The Alternative results in public debt very near to 190 percent of GDP by 2035—which would be an ultimate record.

What struck me as most striking about this projection is that the grim but lower case assumes virtually no changes in law. As a consequence revenues would increase because the Bush tax cuts would expire and the alternative minimum tax provisions on the books would, as written, bring in increasing revenues. “At the same time,” quoting the CBO now, “under this scenario, government spending on everything other than the major mandatory health care programs, Social Security, and interest on federal debt—activities such as national defense and a wide variety of domestic programs—would decline to the lowest percentage of GDP since before World War II.” In other words we would allow taxes to rise and the health program on the books now to unfold as written, no new programs would be created, and the old programs would retain their funding at current levels. And that produces an 84 percent of GDP debt by 2035.

In the Alternative scenario, Congress will extend the Bush tax once again and take the bite out of the alternative minimum tax provisions. Minimum payments to physicians under Medicare—which would decline by a third under current law—would be permitted to remain at current levels. Further, shifting the burden for health care to the states, which is part of current law, will not take place as planned.

Now if you react as I did to the study of CBOs two cases, you might say, with Shakespeare—a plague on both your houses! The “good” case produces a ridiculously high rate of public debt. And the provisions that largely support it (letting tax cuts lapse, shifting burden to the states, and shorting doctors of their pay) are about as attractive as a sand-and-seaweed sandwich on the beach.

Revealingly, CBO lacks a third case, one that might actually produce really good results. It would have three legs. One would be increases in income taxes to the level of the early 1960s; two would be a Federal health care system applied with hard rules (cost control) and administered centrally rather than by insurance companies; and the third leg of this stool I’d gladly leave undefined. Any legislature with the guts and foresight to enact the first two could be trusted to get the rest of it right!

You wonder about the tax rates in the early 1960s? Check out this post on the old LaMarotte. Isn’t the current debt more like 98 percent of GDP? Well, I thought so too. But that number was for 2010. CBO, perhaps, has a sharper pen—and they’re projecting 2011 results.

Saturday, June 25, 2011

Public Sector Employment

As I showed earlier this month here, our elected leaders caused heavy lay-offs in the public sector. This comes about despite the mantra of Jobs, Jobs, Jobs—because coherent, rational policies are shredding and blowing away in the wind. Budgets must be cut everywhere because tax increases have become the ultimate sin in politics. Therefore the first task in Job One, which our elected officials think is Job Creation is, in fact, Job Destruction at the local level—which is where most of the public jobs actually are.

Anecdotal evidence, in the form of news reports, has since amply documented the statistical evidence I presented on June 4. Yesterday the papers announced huge layoffs and salary cuts in the Detroit Public School System. Today’s New York Times projects the likely loss of 7,500 public jobs in Connecticut because the unions there decided not to disembowel themselves to please the tax cutters. Another story, also page one, announces that in New York state and elsewhere, schools are sacrificing librarians to stay within their shrinking budgets. I expect more red lines when next I produce my chart on June’s employment situation by sector.

It is said that the public employment created during the Depression by FDR did not really turn things around. World War II, however, did. We have huge expenditures on war today, of course, but these wars are not having the same effect. Why? We are not taxing the public to pay for them—and instead of signaling hope with publicly funded jobs, we are radicalizing those sectors of the working world that attract the socially-motivated, our real patriots.

Anecdotal evidence, in the form of news reports, has since amply documented the statistical evidence I presented on June 4. Yesterday the papers announced huge layoffs and salary cuts in the Detroit Public School System. Today’s New York Times projects the likely loss of 7,500 public jobs in Connecticut because the unions there decided not to disembowel themselves to please the tax cutters. Another story, also page one, announces that in New York state and elsewhere, schools are sacrificing librarians to stay within their shrinking budgets. I expect more red lines when next I produce my chart on June’s employment situation by sector.

The facts are that the bulk of the much-derided public sector is (1) local and (2) consists of educational services. As of May 2011, all told we had 22.1 million public employees, representing 17 percent of all employment. Of these 22.1 million 64 percent work at the local level—and 56 percent of them are in education.

Of the 22.1 million workers in the public sector, nearly half, 10.9 million, work in education or in the postal system. If we look at the state and local employment only, 10.3 million of 19.3 million (53%) work in education. And if we look closely at the 9 million who are not in education, we discover that most of them work in such useful and necessary functions as law enforcement, water and sewage systems, and other jobs at least as valuable as manufacturing soups or cell phones. Education represents 47 percent of all public sector employment—and if we add in postal services, the percent rises to 49.

Topsy-turvy. Teachers, librarians, janitors working at schools, school bus drivers, special education experts, are paying for the sins of speculators, hedge-fund traders, and other lords of the universe who—instead of going on pilgrimage to Rome in sackcloth are, based on other anecdotal evidence, once more pulling down monstrous bonuses.

It is said that the public employment created during the Depression by FDR did not really turn things around. World War II, however, did. We have huge expenditures on war today, of course, but these wars are not having the same effect. Why? We are not taxing the public to pay for them—and instead of signaling hope with publicly funded jobs, we are radicalizing those sectors of the working world that attract the socially-motivated, our real patriots.

Tuesday, June 21, 2011

Class Action

The Supreme Court’s 5-4 decision in the Wal-Mart case is producing predictable reactions, echoed back in headlines and editorials (Wal-Mart Stores, Inc. v. Dukes et al., reachable here). This was a class action suit brought in the name of Betty Dukes and four other women (Edith Arana, Dee Gunter, Christine Kwapnoski, Stephanie Odle) who stand in for 1.5 million women who’ve worked for Wal-Mart and collectively charged that Wal-Mart managers systematically discriminated in pay and promotions in favor of males.

The issue here, in my opinion, is not that women consistently and routinely earn less than men. Both in this version and in the old LaMarotte I’ve argued that point using national statistics more than once. The issue is whether such discrimination arises from a conscious, deliberate, and official act by the management of Wal-Mart, thus a policy, a policy that Wal-Mart managers followed because they were required to do so. That’s it, isn’t it? Or am I being unnecessarily rational? When you have a nation where women are consistently earning less than men, yes even if they are equally qualified and in the high professions, is the aim of class action suits really rationally based? Or is the motive something else? Could it be money? Not necessarily. Certainly not in this case.

The law firm representing Betty Dukes and the other women was Impact Fund, a Berkley-based not-for profit law firm begun in 1992. In its last fiscal year (2009-2010), Impact Fund had revenues of $1.2 and expenses of $1.07 million—most of the income being grants and contributions, a mere $65,000 being attorney’s fees and costs (I presume they mean cost reimbursements). That $65,000 covered Impact Fund’s rental costs which happened to be $64,290 in that fiscal year. The firm’s annual report is available here.

Based on the profile of the law firm behind Betty Dukes et al., this litigation was not the usual attempt at raiding deep pockets. My own interpretation, based on looking at the firm’s history—it belongs in a category called “public interest litigators”—is that it is itself, you might say, a class action, thus the action of a segment of the well-educated upper class, people who want to do good things—and within the system rather than outside, thus by terrorism, violence, sabotage, etc. Public interest litigators also have what might be viewed as a “private interest” counterpart, the people who do go after deep pockets precisely because they’re deep.

Now here I would note that good will and a benevolent stance do not, in combination, always magically produce consistently rational reasoning. I am personally certain that Wal-Mart is not unique, thus the company does not have a policy of discriminating against women. What Wal-Mart lacks is what the nation lacks as a whole—namely, to use an ugly word, a proactive will to correct an imbalance in the compensation of women arising from (1) the traditional female role in the home, (2) the lack of aggressive traits in females, traits that are innate in males, (3) the powerful tendency to pay as little as possible (for anything), and (4) women’s willingness to work for lower wages. But if Wal-Mart doesn’t have a policy, why should it be singled out for punishment? Isn’t that a certain species of injustice too?

This case, now decided in favor of Wal-Mart, shows the difficulties of working within a system, piecemeal, in a great fog of societal decline. The consistent, rational solution to unequal pay for women would have to be a national, and indeed draconian, program—a nationally set single wage system, every job classified, heavy punishment for either working for or paying wages outside that system, enforced by a gigantic bureaucracy of Pay Police, each member of which, at every level, would be paid the same, whether female or male.

The issue here, in my opinion, is not that women consistently and routinely earn less than men. Both in this version and in the old LaMarotte I’ve argued that point using national statistics more than once. The issue is whether such discrimination arises from a conscious, deliberate, and official act by the management of Wal-Mart, thus a policy, a policy that Wal-Mart managers followed because they were required to do so. That’s it, isn’t it? Or am I being unnecessarily rational? When you have a nation where women are consistently earning less than men, yes even if they are equally qualified and in the high professions, is the aim of class action suits really rationally based? Or is the motive something else? Could it be money? Not necessarily. Certainly not in this case.

The law firm representing Betty Dukes and the other women was Impact Fund, a Berkley-based not-for profit law firm begun in 1992. In its last fiscal year (2009-2010), Impact Fund had revenues of $1.2 and expenses of $1.07 million—most of the income being grants and contributions, a mere $65,000 being attorney’s fees and costs (I presume they mean cost reimbursements). That $65,000 covered Impact Fund’s rental costs which happened to be $64,290 in that fiscal year. The firm’s annual report is available here.

Based on the profile of the law firm behind Betty Dukes et al., this litigation was not the usual attempt at raiding deep pockets. My own interpretation, based on looking at the firm’s history—it belongs in a category called “public interest litigators”—is that it is itself, you might say, a class action, thus the action of a segment of the well-educated upper class, people who want to do good things—and within the system rather than outside, thus by terrorism, violence, sabotage, etc. Public interest litigators also have what might be viewed as a “private interest” counterpart, the people who do go after deep pockets precisely because they’re deep.

Now here I would note that good will and a benevolent stance do not, in combination, always magically produce consistently rational reasoning. I am personally certain that Wal-Mart is not unique, thus the company does not have a policy of discriminating against women. What Wal-Mart lacks is what the nation lacks as a whole—namely, to use an ugly word, a proactive will to correct an imbalance in the compensation of women arising from (1) the traditional female role in the home, (2) the lack of aggressive traits in females, traits that are innate in males, (3) the powerful tendency to pay as little as possible (for anything), and (4) women’s willingness to work for lower wages. But if Wal-Mart doesn’t have a policy, why should it be singled out for punishment? Isn’t that a certain species of injustice too?

This case, now decided in favor of Wal-Mart, shows the difficulties of working within a system, piecemeal, in a great fog of societal decline. The consistent, rational solution to unequal pay for women would have to be a national, and indeed draconian, program—a nationally set single wage system, every job classified, heavy punishment for either working for or paying wages outside that system, enforced by a gigantic bureaucracy of Pay Police, each member of which, at every level, would be paid the same, whether female or male.

Monday, June 20, 2011

Days When I Love to Hate Computers

Updating B’s machine to Internet Explorer 9. The stress of such ventures is awesome at my age. It takes part of a morning as the interminable downloads proceed and percentage changes, very slowly, mark progress on the screen. The ghouls of our age have names like Service Pack 2. Now I couldn’t install Explorer 9 because Service Pack 2 was missing. So I am now into the first hour of getting the pack. The tension mounts. As soon as Service Pack 2 is finally installed, I’ve no idea if Explorer 9 will be there or not. Probably not. Will I then have to begin that process all over again? Maybe so or maybe not.

Later...

Maybe so! Turns out they’d downloaded a bloody icon already, but when I clicked on it, they announced that now they are downloading the program. But—and there’s always a but—the downloading “requires updates,” and now I am into the first quarter hour (minimally) of the updates. After that, no doubt, they will want to “restart” again, and what with swifty Vista, the restart is another interminable process. Time to vacuum some rugs while the green bar advances in micro-milimeters-an-hour from left to right...

Later...

Yep. Restart it was, the full nine yards. But then, at last B’s computer’s now equipped with Internet Explorer 9, the cat’s meow. Let’s see it trot its new, glamorous stuff. And I asked Explorer 9 to dance. Then came the discovery that Explorer 9, the cat’s meow, operates slower than frozen molasses flow. I launched investigation to discover the reason why. Turns out that the thing comes with so many glorious so-called “add-ons” that every keystroke or mouse movement is monitored by an army of these, every add-on waiting for its chance to add itself on. After a frustrating twenty minutes, every add-on became a has-been-add-on. Explorer now not only looks like the last one, Version 7, but operates as fast as the ancient version of two years ago. So B’s machine is back to the future, as it were, but at least the version number has changed—and Google will now finally show her her Google Profile again, which Google refused to do this morning, which is what started all this in the first place.

Later...

Maybe so! Turns out they’d downloaded a bloody icon already, but when I clicked on it, they announced that now they are downloading the program. But—and there’s always a but—the downloading “requires updates,” and now I am into the first quarter hour (minimally) of the updates. After that, no doubt, they will want to “restart” again, and what with swifty Vista, the restart is another interminable process. Time to vacuum some rugs while the green bar advances in micro-milimeters-an-hour from left to right...

Later...

Yep. Restart it was, the full nine yards. But then, at last B’s computer’s now equipped with Internet Explorer 9, the cat’s meow. Let’s see it trot its new, glamorous stuff. And I asked Explorer 9 to dance. Then came the discovery that Explorer 9, the cat’s meow, operates slower than frozen molasses flow. I launched investigation to discover the reason why. Turns out that the thing comes with so many glorious so-called “add-ons” that every keystroke or mouse movement is monitored by an army of these, every add-on waiting for its chance to add itself on. After a frustrating twenty minutes, every add-on became a has-been-add-on. Explorer now not only looks like the last one, Version 7, but operates as fast as the ancient version of two years ago. So B’s machine is back to the future, as it were, but at least the version number has changed—and Google will now finally show her her Google Profile again, which Google refused to do this morning, which is what started all this in the first place.

Saturday, June 18, 2011

Social Networks

What do Lady Gaga (10,999,135), Justin Bieber (10,436,368), Barack Obama (8,687,105), Britney Spears (8,234,189), and Kim Kardashian (7,915,103) have in common? Big numbers, for one thing. The numbers I reproduce are the followers they have on Twitter according to twittercounter.com (here). They are, in the order shown, the five most popular tweeters in the world.

Barack Obama stands out in two ways. He is not an entertainer, and he is the only person in the list who is over 31 years of age. For those fading few like me who did not recognize but perhaps two names on the list, Lady Gaga is Stefani Germanatta, a pop singer, aged 25; Justin Bieber is a 17-year-old Canadian singer; Britney Spear, 30, is a recording artist and entertainer, and Kim Kardashian, 31, is described by Wikipedia as a “personality” and a “socialite.”

The times are changing. What we are pleased to call “communications” is morphing into something very strange, never before seen—but, I hasten to add, so were newspapers when they first appeared in the wake of mechanized printing in the seventeenth century. Indeed, the social networks, which are now coming to dominance, are the consequence of electronic communications media. Growth rates are astonishing. Here is a graphic, built from data on this Facebook site, of three of them:

The big name (for now) is Facebook. The hot new property is Twitter. It more than doubled between last year and this. Twitter had 100 members (that’s one hundred, not a typo) in March 2006. LinkedIn, a business net-working site, has recently gone public and is now, suddenly, cluttering up my e-mail inbox.

It’s well to remember that “networking” actually pre-dates the Internet. The concept surfaced in the 1960s and was well established as a concept, indeed even as a quasi-institutional phenomenon, by the 1970s—long before the Internet was commercialized in 1995. You got ahead, it was said, by cultivating a network of well-placed acquaintances—courting them, as it were, consciously, with your own career in mind. I clearly remember once attending a seminar during the 1973-1975 recession; I was looking for consulting clients at the time, a tough time economically; the seminar much disappointed me. It had been too cleverly named. Everybody at the meeting was also looking for clients too— and not a client in sight! LinkedIn, not surprisingly, was the first of these social networks, established in December of 2002. Facebook began in February 2004, and Twitter appeared officially in July of 2006.

The growth in networks is matched by explosive growth in mobile devices. In the third quarter of 2010 alone, 417 million mobile phones were sold worldwide. And in that same time period, another 80.5 million smartphones were purchased. I have this from Marketsize entries reachable here. Instant availability of linkage to a global com-system, with or without wire, is matched by services that link people to each other—and to the personalities they wish to know all about, up to the minute, as it were.

Over against this we have a decline in the by now “traditional” newspaper establishment. In 2010 the top 100 newspapers in the United States had a daily circulation of a mere 21.9 million. Per Reuters, 379 papers had a daily circulation of 30.4 million in 2009, having declined 4.6 percent from 2008. As circulation drops and newspapers first thin out and then disappear, our carbon footprint is also presumably shrinking. Or so it would seem on the surface. The truth is that we can’t know for sure. Is the energy we save by producing less newsprint now consumed in making millions of electronic devices so that our population can keep in touch with events, like Now, like in Real Time, while On the Go?

Barack Obama stands out in two ways. He is not an entertainer, and he is the only person in the list who is over 31 years of age. For those fading few like me who did not recognize but perhaps two names on the list, Lady Gaga is Stefani Germanatta, a pop singer, aged 25; Justin Bieber is a 17-year-old Canadian singer; Britney Spear, 30, is a recording artist and entertainer, and Kim Kardashian, 31, is described by Wikipedia as a “personality” and a “socialite.”

The times are changing. What we are pleased to call “communications” is morphing into something very strange, never before seen—but, I hasten to add, so were newspapers when they first appeared in the wake of mechanized printing in the seventeenth century. Indeed, the social networks, which are now coming to dominance, are the consequence of electronic communications media. Growth rates are astonishing. Here is a graphic, built from data on this Facebook site, of three of them:

The big name (for now) is Facebook. The hot new property is Twitter. It more than doubled between last year and this. Twitter had 100 members (that’s one hundred, not a typo) in March 2006. LinkedIn, a business net-working site, has recently gone public and is now, suddenly, cluttering up my e-mail inbox.

It’s well to remember that “networking” actually pre-dates the Internet. The concept surfaced in the 1960s and was well established as a concept, indeed even as a quasi-institutional phenomenon, by the 1970s—long before the Internet was commercialized in 1995. You got ahead, it was said, by cultivating a network of well-placed acquaintances—courting them, as it were, consciously, with your own career in mind. I clearly remember once attending a seminar during the 1973-1975 recession; I was looking for consulting clients at the time, a tough time economically; the seminar much disappointed me. It had been too cleverly named. Everybody at the meeting was also looking for clients too— and not a client in sight! LinkedIn, not surprisingly, was the first of these social networks, established in December of 2002. Facebook began in February 2004, and Twitter appeared officially in July of 2006.

The growth in networks is matched by explosive growth in mobile devices. In the third quarter of 2010 alone, 417 million mobile phones were sold worldwide. And in that same time period, another 80.5 million smartphones were purchased. I have this from Marketsize entries reachable here. Instant availability of linkage to a global com-system, with or without wire, is matched by services that link people to each other—and to the personalities they wish to know all about, up to the minute, as it were.

Over against this we have a decline in the by now “traditional” newspaper establishment. In 2010 the top 100 newspapers in the United States had a daily circulation of a mere 21.9 million. Per Reuters, 379 papers had a daily circulation of 30.4 million in 2009, having declined 4.6 percent from 2008. As circulation drops and newspapers first thin out and then disappear, our carbon footprint is also presumably shrinking. Or so it would seem on the surface. The truth is that we can’t know for sure. Is the energy we save by producing less newsprint now consumed in making millions of electronic devices so that our population can keep in touch with events, like Now, like in Real Time, while On the Go?

Labels:

Facebook,

LinkedIn,

Networking,

Social Networks,

Twitter

Monday, June 13, 2011

Pyramid Revisited

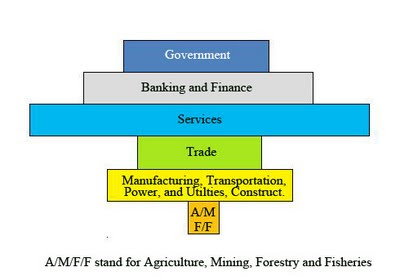

In an earlier post on the “old” LaMarotte, here, under the title of “What Goes Up, Must Come Down,” I presented a pyramid of the economy. This one:

My argument there was that the economy basically rests on Agriculture, Forestry, Fishing, and Mining—thus on the acquisition of the basic stuff of life. All other activities rest on that foundation. Advanced economic life, and above all urban life, depend on the sectors piled above it—and indeed dependent on the base. I also said that to the extent that any layer depends on its well-being on one above it, to that extent it is also vulnerable to problems that arise there. The example I cited is the dependence of Agriculture on heavy machinery, oil, and financing. Wealth cumulates as we extend the pyramid. And for all things to go well, that which goes up (money) must also come down again. We need a proper circulation of human energies, which, in a way, money represents. Hence a financial meltdown affects all sectors.

In a comment on that post, Monique wrote:

The bars are proportioned here by each sectoral cluster’s contribution to the Gross Domestic Product measured as Value Added. In this graphic I have added Government, missing from the earlier graphic—where, if I’d drawn it in, it would have been the smallest item and at the very tip.

Government is large because it includes education—public schools at the local and universities at the state level. Some education, privately managed, is in Services. Trade here means Wholesale and Retail Trade. Warehousing ought to be in that sector, but my source puts it in with Transportation and I cannot tease it out. If this chart were based on employment, rather than money, Banking and Finance would be smaller, Trade would be much larger, and the bottom (Ag, Mining) sector would be even smaller than it already is. One of these days I'll post an employment-based pyramid too...

For many decades now I’ve argued that modern economies are inverted pyramids when measured either in money or in employment. Very small numbers of people vitally support the total structure. You might liken it to a child’s spinning top—which only keep right side up because of the whipping—thus the flow of energy, the circulation of money. The most stable, reliable, and lasting economies don’t have much motion. They’re just sitting solidly on the firm base of fundamental human life, close to the earth—with just about everybody engaged in basic activities. And this pyramid shows that as well.

I will end this post as I ended the other. Appropriate, mutually supportive exchange is the guarantee of welfare all around. The Banking and Finance sector accumulates excess wealth. It—or Government—must ensure that it goes down again. If the wealth is spoiled at the top, it will affect the bottom. But when everything fails, we’ll still be hunting and gathering.

My argument there was that the economy basically rests on Agriculture, Forestry, Fishing, and Mining—thus on the acquisition of the basic stuff of life. All other activities rest on that foundation. Advanced economic life, and above all urban life, depend on the sectors piled above it—and indeed dependent on the base. I also said that to the extent that any layer depends on its well-being on one above it, to that extent it is also vulnerable to problems that arise there. The example I cited is the dependence of Agriculture on heavy machinery, oil, and financing. Wealth cumulates as we extend the pyramid. And for all things to go well, that which goes up (money) must also come down again. We need a proper circulation of human energies, which, in a way, money represents. Hence a financial meltdown affects all sectors.

In a comment on that post, Monique wrote:

Now, wouldn’t it be interesting to see this pyramid made in such a way that each sector’s importance to the GDP were reflected…? I’ll bet that would turn things on their head!Well, I thought, that’s a good point. It’s been a while, but now I’ve gotten around to doing it. I’ve constructed the pyramid Monique asked for. Now she is a knowledgeable economics maven, as it were, and she was, of course, right on. The pyramid inverts. The data I used came from this Bureau of Economic Analysis publication, p. 14, for 2010. Here is the graphic:

The bars are proportioned here by each sectoral cluster’s contribution to the Gross Domestic Product measured as Value Added. In this graphic I have added Government, missing from the earlier graphic—where, if I’d drawn it in, it would have been the smallest item and at the very tip.

Government is large because it includes education—public schools at the local and universities at the state level. Some education, privately managed, is in Services. Trade here means Wholesale and Retail Trade. Warehousing ought to be in that sector, but my source puts it in with Transportation and I cannot tease it out. If this chart were based on employment, rather than money, Banking and Finance would be smaller, Trade would be much larger, and the bottom (Ag, Mining) sector would be even smaller than it already is. One of these days I'll post an employment-based pyramid too...

For many decades now I’ve argued that modern economies are inverted pyramids when measured either in money or in employment. Very small numbers of people vitally support the total structure. You might liken it to a child’s spinning top—which only keep right side up because of the whipping—thus the flow of energy, the circulation of money. The most stable, reliable, and lasting economies don’t have much motion. They’re just sitting solidly on the firm base of fundamental human life, close to the earth—with just about everybody engaged in basic activities. And this pyramid shows that as well.

I will end this post as I ended the other. Appropriate, mutually supportive exchange is the guarantee of welfare all around. The Banking and Finance sector accumulates excess wealth. It—or Government—must ensure that it goes down again. If the wealth is spoiled at the top, it will affect the bottom. But when everything fails, we’ll still be hunting and gathering.

Friday, June 10, 2011

The Weather Backs All Sides

Awakened this morning by the sound of my teeth rattling from the cold, I vaguely remembered the same moment two days ago when I thought that an evil angel had transported me during the night to the hottest point on the equator. Outdoor temperatures this morning were 59 degrees, the wind brisk. The night before, at six p.m., it had been 91 degrees.

Something of PBS’s Newshour was in that thought. Last night I’d watched a segment titled Arizona Wildfire Spreads as Record-Breaking Heat Wave Grips Eastern U.S. As part of that segment Ray Suarez interviewed one Evan Myers from AccuWeather. Mr. Meyers had a rather interesting map in the background behind him. Here is a picture of both, the map and Mr. Meyers:

And this happens in all seasons. Wherever you are in the United States, and presumably elsewhere in the world as well, be sure that the Weather will oblige your favored view of climate change. Not every day, to be sure, but often enough—so that Global Warmers and New Ice Agers will both be able to point at thermometers by way of seeking infallible evidence.

The map behind Mr. Meyers, however, does give me a certain amount of hope. The color for my region is green, the word is WET, and neither heat nor warmth nor dryness nor cool appear within the green. We’ll get through this summer yet, we in the upper middle with that southern tail. Not, to be sure, the rest of youse.

Something of PBS’s Newshour was in that thought. Last night I’d watched a segment titled Arizona Wildfire Spreads as Record-Breaking Heat Wave Grips Eastern U.S. As part of that segment Ray Suarez interviewed one Evan Myers from AccuWeather. Mr. Meyers had a rather interesting map in the background behind him. Here is a picture of both, the map and Mr. Meyers:

The map had triggered a number of insights. One was the realization that our Weather, and I capitalize that word with full respect, is determined to take no sides in the years-long debate about Global Warming. It is determined to make you go to sleep one night thinking that Global Warming is absolutely here, only to make you wake up the following night certain that the New Ice Age is obviously on the doorstep.

The map behind Mr. Meyers, however, does give me a certain amount of hope. The color for my region is green, the word is WET, and neither heat nor warmth nor dryness nor cool appear within the green. We’ll get through this summer yet, we in the upper middle with that southern tail. Not, to be sure, the rest of youse.

Tuesday, June 7, 2011

When Cynicism is Rational

On July 26, 2010, thus five days after its passage, Fox News ran this headline: As Finance Bill Passes, GOP Calls for Repeal. The finance bill in question was the Dodd-Frank Wall Street Reform and Consumer Protection Act. The law as published (here) is divided into sixteen titles and runs 849 pages in length. Some of the more thoughtful summaries of it run more than a hundred pages. Herewith a summary of summaries, thus just a list of hoped-for results. The act…

• Creates a consumer protection watchdog agency (Consumer Financial Protection Bureau); CFPB has some regulatory powers.

• Ends to big to fail, by requiring higher capital requirements, prohibiting tax-payer bailouts, establishing rules for orderly liquidation, and more.

• Creates a council to look ahead and to warn of impending repeats of the last fiasco (Financial Stability Oversight Council); FSOC can, by 2/3 votes, cause the Federal Reserve to act in some instances.

• Makes exotic instruments (derivatives, hedge-funds) more visible to the public, the hope being that that will have a positive effect.

• Regulates compensation of executives by giving stockholders more powers.

• Regulates credit rating agencies by creating an Office of Credit Ratings within the Securities and Exchange Commission

• Strengthens already available oversight and enhances enforcement powers.

According to DavisPolk, a law firm and leading tracker of this legislation (see here), the act requires 387 different rulemakings by 20 different agencies. Of these 275 have deadlines, 112 do not. Of those that do, 129 must be made by the third quarter of 2012, 46 after 2012. As of May 1, 2012, 148 rulemakings were supposed to have been completed. Only 21 were finalized, another 97 had been proposed, and 30 deadlines had been altogether missed. I’ve reproduced a pie chart DavisPolk provides. What it says is that, essentially, we’re not even near.

I’ve spent multiple years of my life in the EPA with initially 300 and later 150 people trying to implement a law that was about 25 pages in length—and one agency, alone, responsible for it. Here we have 20 agencies and 849 pages. To that now famed phrase, Too Big To Fail, we can rationally join another: Too Big To Regulate. Senator Dodd and Representative Frank, bless them, gave it the college try. To another old phrase—The mountain labored and brought forth a mouse—I now propose to join another: The planet labored and brought forth a bacterium; alas it was dead. The GOP’s strategy of defeating Dodd-Frank is centered on delay. Maybe they can also gain the Senate and then repeal the package as a whole.

Alas and alack, only draconian measures would have worked. Let me spell them out. Outright bans of exotic instruments like hedge-funds, futures trading, and all derivates should have been the first paragraph of Title I. Legislatively required and numerically stated reserve requirements by banks should have come next. Then in titles III, IV, and V (say), the bill might have established commissions and boards and such to study the subject more, perhaps to ease these drastic measures, always by two-thirds vote, with mandatory deadlines stating, “Not sooner than 2055.”

Draconian measures? Well, there was a guy called Draco once, an Athenian. He put out a code of laws in 621 BC that mandated the death sentence for minor crimes. My own suggestion may therefore not be draconian enough.

• Creates a consumer protection watchdog agency (Consumer Financial Protection Bureau); CFPB has some regulatory powers.

• Ends to big to fail, by requiring higher capital requirements, prohibiting tax-payer bailouts, establishing rules for orderly liquidation, and more.

• Creates a council to look ahead and to warn of impending repeats of the last fiasco (Financial Stability Oversight Council); FSOC can, by 2/3 votes, cause the Federal Reserve to act in some instances.

• Makes exotic instruments (derivatives, hedge-funds) more visible to the public, the hope being that that will have a positive effect.

• Regulates compensation of executives by giving stockholders more powers.

• Regulates credit rating agencies by creating an Office of Credit Ratings within the Securities and Exchange Commission

• Strengthens already available oversight and enhances enforcement powers.

According to DavisPolk, a law firm and leading tracker of this legislation (see here), the act requires 387 different rulemakings by 20 different agencies. Of these 275 have deadlines, 112 do not. Of those that do, 129 must be made by the third quarter of 2012, 46 after 2012. As of May 1, 2012, 148 rulemakings were supposed to have been completed. Only 21 were finalized, another 97 had been proposed, and 30 deadlines had been altogether missed. I’ve reproduced a pie chart DavisPolk provides. What it says is that, essentially, we’re not even near.

I’ve spent multiple years of my life in the EPA with initially 300 and later 150 people trying to implement a law that was about 25 pages in length—and one agency, alone, responsible for it. Here we have 20 agencies and 849 pages. To that now famed phrase, Too Big To Fail, we can rationally join another: Too Big To Regulate. Senator Dodd and Representative Frank, bless them, gave it the college try. To another old phrase—The mountain labored and brought forth a mouse—I now propose to join another: The planet labored and brought forth a bacterium; alas it was dead. The GOP’s strategy of defeating Dodd-Frank is centered on delay. Maybe they can also gain the Senate and then repeal the package as a whole.

Alas and alack, only draconian measures would have worked. Let me spell them out. Outright bans of exotic instruments like hedge-funds, futures trading, and all derivates should have been the first paragraph of Title I. Legislatively required and numerically stated reserve requirements by banks should have come next. Then in titles III, IV, and V (say), the bill might have established commissions and boards and such to study the subject more, perhaps to ease these drastic measures, always by two-thirds vote, with mandatory deadlines stating, “Not sooner than 2055.”

Draconian measures? Well, there was a guy called Draco once, an Athenian. He put out a code of laws in 621 BC that mandated the death sentence for minor crimes. My own suggestion may therefore not be draconian enough.

Monday, June 6, 2011

Clouds of Glory

The following post first appeared on July 20, 2009 on the “Old” Lamarotte. I thought I’d republish it here now that Apple has just announced its iCloud. The facts haven’t changed.

“The Cloud” or “cloud computing” is now starting to show up in newspaper features, suggesting that a ramp-up to commercial initiatives is under way. The assumption is that this idea is something new, better yet, “a new paradigm”; that phrase has what we once called panache. In a sentence: all of our data and software reside on the Internet rather than on our hard drive. The supposed benefit is that if the computer fails or the laptop is stolen, nothing is lost. Another much-touted feature of cloud computing is that many individuals can use the same data simultaneously, which might be useful in a corporate setting—or so it’s claimed. How many people does it take to write a single letter? or a report? It’s best if the answer is one. The quality drops geometrically as authors are multiplied. But never mind. We are now deep, deep into group grope, group talk, group think, group fun, group everything…

The Cloud reminds me of the Mainframe Days. Let’s pinpoint it and say 1960 or thereabouts. The hardware platform was the massive mainframe; it held all the data; it also provided all of the CPU cycles. We reached the computer by means of terminals. Unlike PCs terminals had no chip; they were dumb input and output devices, hence the phrase “dumb terminal.” They sent keystrokes and displayed symbols on a screen (if you were so lucky); many had to reach over and look at scrolling paper on which the mainframe gave its oracular responses. The big draw-back of the mainframe was slow speed—when the number of users shot up. At least dozens and usually many more people working at the same time shared a single or a cluster of CPUs, and at times the mainframe was slow to distraction. Distant mainframes also predate The Cloud. To use a computer far away by means of terminals and dedicated phone lines was known as time-shared computing. Also very slow. The speed of data transfer has since greatly increased. If the terminal is replaced by a good computer, the server no longer needs to supply all of the CPU cycles. They are provided by the user’s machine.

What’s so hot about this idea? Group work is one answer—but networks already provide all the group-stuff we really need. Safety is the other, but that issue is really rather overrated. Those who really need to save their data know that. For that reason they use redundant means of backup. They back up computers and prepare multiple additional archival CDs on which the information is held—the copies often transported to different locations so that a fire or flood at the place of work cannot destroy the symbolic wealth. Are we justified in trusting managers of The Cloud more than our own systems? Are those distant managers beyond the reach of misfortune, fires, or terrorist attacks? I apologize for being cynical, but it seems to me that safety is just a red herring.

What’s really hot about The Cloud is that it offers someone else—not us, the users—a new way of making money out of data-storage and software by levying a continuous recurring charge on the hapless user. The service is by subscription. This means that we, as users, pay and keep on paying. Use The Cloud and turn into a Cash Cow. Back in the good old Mainframe Days, companies like IBM charged even for the use of their Operating Systems the same way—and levied fees for using other software on top of that. It was a monthly cost to the customer. Operating systems and software that you could buy once-and-for-all crimped that business model in major ways, but good ideas, like milking the consumer continuously, have a way of returning again. And here they are, coming to us now in a cloud of glory.

* * *

“The Cloud” or “cloud computing” is now starting to show up in newspaper features, suggesting that a ramp-up to commercial initiatives is under way. The assumption is that this idea is something new, better yet, “a new paradigm”; that phrase has what we once called panache. In a sentence: all of our data and software reside on the Internet rather than on our hard drive. The supposed benefit is that if the computer fails or the laptop is stolen, nothing is lost. Another much-touted feature of cloud computing is that many individuals can use the same data simultaneously, which might be useful in a corporate setting—or so it’s claimed. How many people does it take to write a single letter? or a report? It’s best if the answer is one. The quality drops geometrically as authors are multiplied. But never mind. We are now deep, deep into group grope, group talk, group think, group fun, group everything…

The Cloud reminds me of the Mainframe Days. Let’s pinpoint it and say 1960 or thereabouts. The hardware platform was the massive mainframe; it held all the data; it also provided all of the CPU cycles. We reached the computer by means of terminals. Unlike PCs terminals had no chip; they were dumb input and output devices, hence the phrase “dumb terminal.” They sent keystrokes and displayed symbols on a screen (if you were so lucky); many had to reach over and look at scrolling paper on which the mainframe gave its oracular responses. The big draw-back of the mainframe was slow speed—when the number of users shot up. At least dozens and usually many more people working at the same time shared a single or a cluster of CPUs, and at times the mainframe was slow to distraction. Distant mainframes also predate The Cloud. To use a computer far away by means of terminals and dedicated phone lines was known as time-shared computing. Also very slow. The speed of data transfer has since greatly increased. If the terminal is replaced by a good computer, the server no longer needs to supply all of the CPU cycles. They are provided by the user’s machine.

What’s so hot about this idea? Group work is one answer—but networks already provide all the group-stuff we really need. Safety is the other, but that issue is really rather overrated. Those who really need to save their data know that. For that reason they use redundant means of backup. They back up computers and prepare multiple additional archival CDs on which the information is held—the copies often transported to different locations so that a fire or flood at the place of work cannot destroy the symbolic wealth. Are we justified in trusting managers of The Cloud more than our own systems? Are those distant managers beyond the reach of misfortune, fires, or terrorist attacks? I apologize for being cynical, but it seems to me that safety is just a red herring.

What’s really hot about The Cloud is that it offers someone else—not us, the users—a new way of making money out of data-storage and software by levying a continuous recurring charge on the hapless user. The service is by subscription. This means that we, as users, pay and keep on paying. Use The Cloud and turn into a Cash Cow. Back in the good old Mainframe Days, companies like IBM charged even for the use of their Operating Systems the same way—and levied fees for using other software on top of that. It was a monthly cost to the customer. Operating systems and software that you could buy once-and-for-all crimped that business model in major ways, but good ideas, like milking the consumer continuously, have a way of returning again. And here they are, coming to us now in a cloud of glory.

Running Against Europe? Tsk! Tsk!

In the current political environment—and, Lordy Lord, the next election is still seventeen (17!) months away—one candidate has started to use the E-word as a synonym for evil. In that context it is well to remember that, as of the last Population Estimate published by the Census Bureau, nearly 80 percent of the U.S. population is said to be of European origin. If the Europeans are so inept, weak, and subject to E-coli like socialism, yet most Americans come from that stock, the only explanation for the Mighty Healthy American syndrome (MHA) I’m able to offer is the local food. By all means let’s Eat American. And we should immediately write to our Congressperson and demand that he or she insist that the White House not be permitted to serve enervating and decadent delicacies like pâté de foie gras.

Sunday, June 5, 2011

Debt and Taxes

Let’s keep it simple. Where the national debt’s concerned, debt and taxes are intrinsically linked.I found a revealing data set on Wikipedia here. Wikipedia derived the data I show in part from the Congressional Budget Office, in part from a White House FY 2011 Budget tabulation. What I’m showing is the percentage change in national debt between the beginning and the end of each presidential administration. I’ve augmented the data by filling out the chart so that it reflects results for the Obama Administration up to the present time. Herewith is the graphic.

Except for a tiny increase in debt in the Second Nixon/Ford Administration, all administration until Reagan produced decreases in national debt. The red bars start thereafter, Reagan kicking things off. The sole deviation from that pattern came with the two Clinton administrations—where the debt once more dropped.

Red is the Republican, Blue the Democratic color signature. Forgive me for choosing these colors to show the results. Red shows increases in debt, blue decreases. And since Reagan they match the parties. To be sure, three different Republican administrations managed to cut the debt—and to identify them I put a little red in the blue. Seven Democrat administrations managed to cut the debt, Obama’s has not—and therefore I put a little blue in Obama’s red bar.

Quite consciously and deliberately, the Reagan administration let debt accumulate thinking that as it climbed, it would ultimately force cuts and a shrinkage of government. The administration miscalculated. Both parties have powerful urges to reward their respective constituencies. Democrats must spend on social programs to do so; Republicans can only do so by cutting taxes. But Republicans are also motivated to spend—at least on the military-industrial complex; and this urge is also basic and understandable. But the standoff that has developed is beginning to look irresolvable by courteous compromise. Troubling.

Where I come out is that Republicans should not try to hand money to their wealthy constituents by tax cuts—who don’t really need the help. I for one have always delighted in paying taxes—and the more the better. It meant that I was doing better. Then, by compromising on taxation, Republicans can ensure adequate spending on the military.

Real leadership for this sort of compromise must come from the right. The ordinary people must have jobs, healthcare, and schooling—and for this we can’t rely on that bloody Hidden Hand. Where are the genuine aristocrats among Republicans? Traditionalists who understand that nobility obligates—whatever name we call it: virtue, talent, power, wealth. If we all start acting like proles, Katie bar the door.

Except for a tiny increase in debt in the Second Nixon/Ford Administration, all administration until Reagan produced decreases in national debt. The red bars start thereafter, Reagan kicking things off. The sole deviation from that pattern came with the two Clinton administrations—where the debt once more dropped.

Red is the Republican, Blue the Democratic color signature. Forgive me for choosing these colors to show the results. Red shows increases in debt, blue decreases. And since Reagan they match the parties. To be sure, three different Republican administrations managed to cut the debt—and to identify them I put a little red in the blue. Seven Democrat administrations managed to cut the debt, Obama’s has not—and therefore I put a little blue in Obama’s red bar.

Quite consciously and deliberately, the Reagan administration let debt accumulate thinking that as it climbed, it would ultimately force cuts and a shrinkage of government. The administration miscalculated. Both parties have powerful urges to reward their respective constituencies. Democrats must spend on social programs to do so; Republicans can only do so by cutting taxes. But Republicans are also motivated to spend—at least on the military-industrial complex; and this urge is also basic and understandable. But the standoff that has developed is beginning to look irresolvable by courteous compromise. Troubling.

Where I come out is that Republicans should not try to hand money to their wealthy constituents by tax cuts—who don’t really need the help. I for one have always delighted in paying taxes—and the more the better. It meant that I was doing better. Then, by compromising on taxation, Republicans can ensure adequate spending on the military.

Real leadership for this sort of compromise must come from the right. The ordinary people must have jobs, healthcare, and schooling—and for this we can’t rely on that bloody Hidden Hand. Where are the genuine aristocrats among Republicans? Traditionalists who understand that nobility obligates—whatever name we call it: virtue, talent, power, wealth. If we all start acting like proles, Katie bar the door.

Saturday, June 4, 2011

Jobs by Sector, April-May 2011

Once more, as last month (here), I am showing employment change by sector. In the change from March to April, all sectors showed gains but one, Government. This month (April to May) five sectors show losses, the rest gains:

The source of the data shown is this BLS table. Note here especially the loss of 9,000 jobs in the retail sector. Last month that sector, alone, posted a higher gain in jobs than the entire economy this month (57,000 versus 54,000). This month retail gave some of those jobs back. The news speak of people being “shopped out” or having once more “lost confidence.” Not surprisingly. We don’t have a unified national policy. We’re pulling in opposite directions. Keynesian voices keen for more stimulus—but how can we stimulate when we’ve built our Tower of Debt to a nearly World War II percent of GDP by giving artificial respiration to the Finance Sector and fighting—is it two? is it three? is it four? wars all at once? Other voices shout Tax cut, Tax cut, Tax cut—and these voices are louder and winning; they’ve won the last election. But not the last by-election in New York—which really confuses things. Tax cutting has produced shrinking jobs in government. Last month the loss was 24,000; this month it is 29,000. That’s what job-growth by tax-cut looks like, stupidos.

Let’s take a closer look at the government losses. The federal sector actually had a gain of 1,000 jobs; state governments lost 2,000, and the locals 28,000. It’s worst closest to home! And it gets worse. Most of the government job losses (a shade over 60 percent) were experienced by local educational systems, 17,500! That’s where the tax-cuts are landing, folks: on teachers. And that’s starting to look down-right surrealistic. We can afford to build schools in Afghanistan and in Pakistan by means of aid—but we can’t keep our teachers on the job because we must shrink government? Is it any wonder that people have lost their confidence?

In times like these when unity of purpose is essential, our governance structure, designed deliberately to produce conflict, is not working to the benefit of the whole.

The source of the data shown is this BLS table. Note here especially the loss of 9,000 jobs in the retail sector. Last month that sector, alone, posted a higher gain in jobs than the entire economy this month (57,000 versus 54,000). This month retail gave some of those jobs back. The news speak of people being “shopped out” or having once more “lost confidence.” Not surprisingly. We don’t have a unified national policy. We’re pulling in opposite directions. Keynesian voices keen for more stimulus—but how can we stimulate when we’ve built our Tower of Debt to a nearly World War II percent of GDP by giving artificial respiration to the Finance Sector and fighting—is it two? is it three? is it four? wars all at once? Other voices shout Tax cut, Tax cut, Tax cut—and these voices are louder and winning; they’ve won the last election. But not the last by-election in New York—which really confuses things. Tax cutting has produced shrinking jobs in government. Last month the loss was 24,000; this month it is 29,000. That’s what job-growth by tax-cut looks like, stupidos.

Let’s take a closer look at the government losses. The federal sector actually had a gain of 1,000 jobs; state governments lost 2,000, and the locals 28,000. It’s worst closest to home! And it gets worse. Most of the government job losses (a shade over 60 percent) were experienced by local educational systems, 17,500! That’s where the tax-cuts are landing, folks: on teachers. And that’s starting to look down-right surrealistic. We can afford to build schools in Afghanistan and in Pakistan by means of aid—but we can’t keep our teachers on the job because we must shrink government? Is it any wonder that people have lost their confidence?

In times like these when unity of purpose is essential, our governance structure, designed deliberately to produce conflict, is not working to the benefit of the whole.

Friday, June 3, 2011

Employment: Update May 2011

The misery continues! Last month I reported a gain of 244,000 jobs, but this month the Bureau of Labor Statistics revised the April figure downward, to 205,000—thus we start with a loss of 39,000 jobs. In May the economy gained a mere 54,000 jobs, and if we net out the revision for April, the actual gain drops to a mere 15,000 jobs. That’s what I call misery.

To recap. In the 2008-2009 period we erased 8.66 million jobs from the economy. Since the first day of 2010, we’ve recovered 1.7 million jobs; that’s the same number as last month—because the gains don’t show up in rounding. Last month I showed a 19.7 percent recovery of the Great Recession losses, this month I show 19.9 percent, not even a full percentage point advance.

Mrs. Economy, invited upstairs to the bedroom for just a brief frolic—just a little fun, it’s been a long time, dear, a lo-o-o-ng time—and yet she once more seems to have a headache. Ah, well. Deep sigh!

Mrs. Economy, invited upstairs to the bedroom for just a brief frolic—just a little fun, it’s been a long time, dear, a lo-o-o-ng time—and yet she once more seems to have a headache. Ah, well. Deep sigh!The data shown are from this BLS press release.

Thursday, June 2, 2011

U.S. Debt Ceiling: Perspectives

The U.S. debt ceiling is now in the news. At times like these, passions high, historical perspectives are usually neglected, hence this small effort to look at the issue over some period of history. Herewith then the debt ceiling since 1940.

Before we get there, a simple definition. The debt ceiling is a legislatively set number. Congress designates a number that the U.S. Treasury may not exceed in cumulative borrowing. The current Debt Ceiling is set at $14.66 trillion, and Secretary Geithner may not borrow more than that. Now, by definition, if the Federal Government must borrow in order to make any payment—and it cannot—because it would exceed the debt ceiling—why then the U.S. Government is technically in default.

With that out of the way, let’s look at some charts. The one we’re most likely to see is the raw dollar level over time. And here it is:

Now the interesting feature of this chart is that the debt ceiling on the left of the chart is virtually invisible—whereas on the right it forms an Everest. But what this chart really shows is that the U.S. economy of the 1940s, in comparison with the economy of the 2000s, was puny. Therefore, to get some necessary perspective, let’s look at another chart.

What we see here is the debt ceiling as a percent of Gross Domestic Product. Interesting, isn’t it? Suddenly the highest peak is now on the left, in the 1940s. In point of fact, at the midpoint of that decade, in 1945, the United States was at the highest level it has ever reached, at 134.5 percent of GDP. On the far right of the chart, in 2010, we are evidently striving for another peak, but we’ve a ways to go. In 2010 the debt ceiling stood at 97.5 percent of GDP.

Now in the 1940s the United States was engaged in a global conflict, World War II. The question then arises, who is the big enemy in 2010? Does the War on Terror really amount to a world war? Or is that bar aspiring to the level of the 1940s really a war against an internal enemy, the Lords of the Universe in Red Suspenders? I incline toward the latter explanation.

But let’s look at growth rates in the following graphic.

Here I’ve calculated the compounded annual growth rate of the debt ceiling from 1940 to each respective year shown. Here the growth of the economy makes itself felt. The most stupendous annual growth rates are shown in the 1940s again, with the highest growth rate achieve in the years 1940 to 1943—62.4 percent a year! Since 1994, however, the annual growth rate, again measured from 1940, has never exceeded 9 percent, and for the entire period, 1940 to 2010, it was 8.4 percent a year. Big growth that, to be sure.

To give a more nuanced view, here is a graphic that shows growth by decade:

Once more we see that the debt ceiling grew most in the 1940-1950 period, least in the following decade—a time when the top tax rate was double that which prevails today. Second highest growth took place in the 1980-1990 period. In the most recent decade, 2000-2010, the ceiling grew at 9.2 percent a year as our mindless military activities coincided with our amoral speculative fevers. Imagine what might have happened in the 1940s and 1950s if, back then, the Greatest Generation had behaved like we do.

The conclusions I draw from these graphics are mixed. First, the sky is not falling down just because our debt ceiling now almost touches 100 percent of GDP. It’s been much worse in the past—and we’ve not only survived that but have had immense economic expansion. But when the debt ceiling rose sky high in the past, we were engaged in genuine global conflict. That’s not the case today. Our current indebtedness is way, way too high. But it is due to our lack of will—to tax! We’re spending billions on wars, but our tax rates are not at war-time highs. That’s the real problem. We should stop wars that don’t defend our borders, and we should tax the people in line with what we spend.

Before we get there, a simple definition. The debt ceiling is a legislatively set number. Congress designates a number that the U.S. Treasury may not exceed in cumulative borrowing. The current Debt Ceiling is set at $14.66 trillion, and Secretary Geithner may not borrow more than that. Now, by definition, if the Federal Government must borrow in order to make any payment—and it cannot—because it would exceed the debt ceiling—why then the U.S. Government is technically in default.

With that out of the way, let’s look at some charts. The one we’re most likely to see is the raw dollar level over time. And here it is:

Now the interesting feature of this chart is that the debt ceiling on the left of the chart is virtually invisible—whereas on the right it forms an Everest. But what this chart really shows is that the U.S. economy of the 1940s, in comparison with the economy of the 2000s, was puny. Therefore, to get some necessary perspective, let’s look at another chart.

What we see here is the debt ceiling as a percent of Gross Domestic Product. Interesting, isn’t it? Suddenly the highest peak is now on the left, in the 1940s. In point of fact, at the midpoint of that decade, in 1945, the United States was at the highest level it has ever reached, at 134.5 percent of GDP. On the far right of the chart, in 2010, we are evidently striving for another peak, but we’ve a ways to go. In 2010 the debt ceiling stood at 97.5 percent of GDP.

Now in the 1940s the United States was engaged in a global conflict, World War II. The question then arises, who is the big enemy in 2010? Does the War on Terror really amount to a world war? Or is that bar aspiring to the level of the 1940s really a war against an internal enemy, the Lords of the Universe in Red Suspenders? I incline toward the latter explanation.

But let’s look at growth rates in the following graphic.

Here I’ve calculated the compounded annual growth rate of the debt ceiling from 1940 to each respective year shown. Here the growth of the economy makes itself felt. The most stupendous annual growth rates are shown in the 1940s again, with the highest growth rate achieve in the years 1940 to 1943—62.4 percent a year! Since 1994, however, the annual growth rate, again measured from 1940, has never exceeded 9 percent, and for the entire period, 1940 to 2010, it was 8.4 percent a year. Big growth that, to be sure.

To give a more nuanced view, here is a graphic that shows growth by decade:

Once more we see that the debt ceiling grew most in the 1940-1950 period, least in the following decade—a time when the top tax rate was double that which prevails today. Second highest growth took place in the 1980-1990 period. In the most recent decade, 2000-2010, the ceiling grew at 9.2 percent a year as our mindless military activities coincided with our amoral speculative fevers. Imagine what might have happened in the 1940s and 1950s if, back then, the Greatest Generation had behaved like we do.

The conclusions I draw from these graphics are mixed. First, the sky is not falling down just because our debt ceiling now almost touches 100 percent of GDP. It’s been much worse in the past—and we’ve not only survived that but have had immense economic expansion. But when the debt ceiling rose sky high in the past, we were engaged in genuine global conflict. That’s not the case today. Our current indebtedness is way, way too high. But it is due to our lack of will—to tax! We’re spending billions on wars, but our tax rates are not at war-time highs. That’s the real problem. We should stop wars that don’t defend our borders, and we should tax the people in line with what we spend.

I have the debt ceiling data from a compilation prepared by Wikipedia here. I’ve taken GDP figures from the Bureau of Economic Development.

Subscribe to:

Posts (Atom)